Do you want to increase your mortgage conversions? Home of Mortgages explain the facts behind the fiction to help you better advise your clients.

Mind-boggling jargon, changes in lenders criteria, and common misconceptions of mortgages in general lead to myths circulating amongst agents and customers that can have a detrimental impact on a client understanding their options. In the following article Home of Mortgages use their expertise to ‘bust’ some of the most commonly believed myths so that you can better advise your clients and achieve more sales by having a better understanding of the lending journey.

Here are 4 myths that Home of Mortgages are demystifying for agents and customers:

Myth 1 - Valuation models are all the same

Myth 2 - Additional Stamp Duty is applied to all buy-to-let properties

Myth 3 - Equity release mortgages are only for releasing equity

Myth 4 - Customers need 3 payslips to apply for a mortgage

Myth 1 - Valuation models are all the same. Busted - they aren’t all the same!

After receiving several offers on a property, a race to valuation is still sometimes used by agents as a way of determining the best buyer. Whilst we can understand why this practice is used, on many occasions now, physical valuations aren't being carried out so where does that leave the potential best buyer?

Here are the types of valuations lenders can use when assessing a property as suitable security. Rather than looking at the survey options available to a buyer such as a lenders valuation, homebuyers report or full structural survey, we are going to look at the different ways in which a lender will decide on a property's value and the process each follows.

AVM (Automated Valuation Model) - This type of valuation has truly sped up the underwriting of mortgage applications by providing an instant (subjective) valuation of a property. Hometrack (owned by ZPG) is the leading AVM with 13 out of the top 15 lenders adopting their software. Using data sets and algorithms an instant valuation can be provided. The more house price data available in a particular area, the more accurate that valuation may be, however this of course won’t take into consideration the condition of a property. Likewise, the AVM won't necessarily know whether a property has been extended or renovated since it was last sold which could greatly impact its value.

Desktop valuations - A desktop valuation is often, incorrectly, used interchangeably with an AVM. An AVM produces a valuation instantly, whereas a desktop valuation will involve a more detailed look at the data available by a RICS qualified surveyor. Past sales data, Google Earth, sales particulars and bespoke software providing a wrath of other geographical and environmental data will all be used to deliver a valuation. A surveyor might decide that a physical valuation needs to be carried out due to the structure of a property for example.

Physical valuation - Considered by some surveyors as the only true way of assessing a property’s value, the physical valuation is just that – the surveyor attends the property in person. Banks have increasingly looked at ways to speed up their processing times by adopting AVM's and Desktop Valuations however, specialist lenders that obtain their funds via the money markets and other wholesale sources are sometimes faced with restrictions that only allow them to lend against properties that have had physical valuations.

Myth 2 - The additional stamp duty rate is for all buy-to-let properties. Busted - it’s a second property rate not a buy-to-let rate

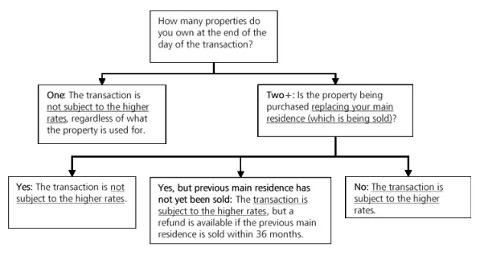

We often hear clients referring to the additional rate of stamp duty as the 'buy-to-let' rate which is incorrect. The 3% additional rate of stamp duty is payable when at the end of the day of the transaction a client owns more than one property and is not replacing their existing residential property. Here are two scenarios where we see the most confusion:

- A first-time buyer purchasing a property to let (Buy to let purchase) – the standard rate applies as the buyer will only own one property on the day this transaction completes will not need to pay the additional rate regardless of the use of the property.

- An owner of a portfolio of buy to let properties, selling their current residence and purchasing a new residence – the standard rate applies because the buyer will be replacing their existing residential with another and freeing up their old property for sale. Therefore, despite them owning other buy to let properties, the additional rate will not apply

- A tenant purchasing their first residential property with someone who owns or part-owns a buy-to-let – the additional rate applies because they are not replacing their existing residential and collectively they own more than one property.

Here is the Stamp Duty table which lays out when the additional rate is payable:

"How many properties do you own at the end of the day Of the transaction? TWO+: Is the property being purchased One The transaction is regardless Of what the property is used for. Yes: The transaction is subiea to the higher rates. Yes, but previous main residence has not yet been sold: The subject to the higher rates, but a refund is available if the previous main residence is sold within 36 months.

Myth 3 - Equity release mortgages are only for releasing equity – Busted Equity release mortgages can be used for onward purchases

Agents often refer clients for an equity release conversation when the property their client intends to purchase is the same or higher in value to the property being sold. However, a client can be referred when they simply want to move but not use all of their funds for their onward purchase to release some funds to live on. As agents and advisors, we are in the business of helping people achieve their property goals. By referring clients for an equity release conversation, we can certainly help more people move and live more comfortably.

When I first started in mortgages at the turn of the century, I remember a family coming to see me in Barclays bank. They were complaining their mother was sold an equity release mortgage, borrowed £50,000 and now owed circa £100,000 in a matter of only five years. After exploring this complaint for them, it turned out to be true. The reason was the type of equity release product being sold at the time meant the life company advancing the funds would benefit from any increase in value of the property so as their mother’s property increased in value, so did the outstanding loan. This was known as a home reversion scheme.

Thankfully, these aren’t the products on offer today and equity release / lifetime mortgages are akin to a standard residential mortgage but with extra features that include:

- Available to anyone over the age of 55

- No income required as the interest due can be added to the debt if you don’t want to make any repayments

- The older you are the more you can borrow

- Fixed interest rates for life - available from 2.89%

- The debt can be serviced meaning payments can be made to avoid the debt increasing on an ad-hoc basis

- Borrowers can move the debt to another property or repay the loan in the future without high penalties

- Available when releasing equity in current home OR for purchasing a new property

- Useful when looking at Inheritance Tax Planning to reduce the value of the estate

Based on what you have just read, how many properties have you valued where the vendors have been over 55? How many of them would benefit from knowing more about their options?

Myth 4 - Customers need 3 payslips to apply for a mortgage. Busted - no they don’t!

Clients often come to us and say “I have just started a new job so I know I have to wait 3 months to get a mortgage” to which we reply “Actually, no you don’t.” We can arrange a mortgage based solely on a future contract of employment without that employment having actually begun. This is a common feature with teachers and in the medical profession where for example a contract might be agreed in May for a September start. A borrower may have to relocate to begin this employment and therefore be on the hunt for a house prior to actually starting their new role.

Alternatively, clients could be looking to remortgage shortly having starting a new job. In these circumstances, yes there are a few lenders that would require a probationary period to be passed but the vast majority would be satisfied that prior experience in the role would exacerbate the need to see this probationary period out before submitting an application.

If a client has been promised an increase in basic pay in the future, lenders will accept a letter from the employer confirming this for use in a mortgage application. Obviously due diligence is carried out by the lender and the new salary will need to be plausible and a start date provided.

The important point here is that proving affordability and sustainability is what matters over length of time in employment.

*Please note different rules apply for the self-employed.