The rise of upfront fees and what we’re seeing across agencies

Upfront fees are no longer unusual in estate agency. They’re becoming the norm, and the pace of adoption is accelerating. With the recent launch of improvements to payments in Kotini, we looked across the agents working with us to see what trends are emerging:

-

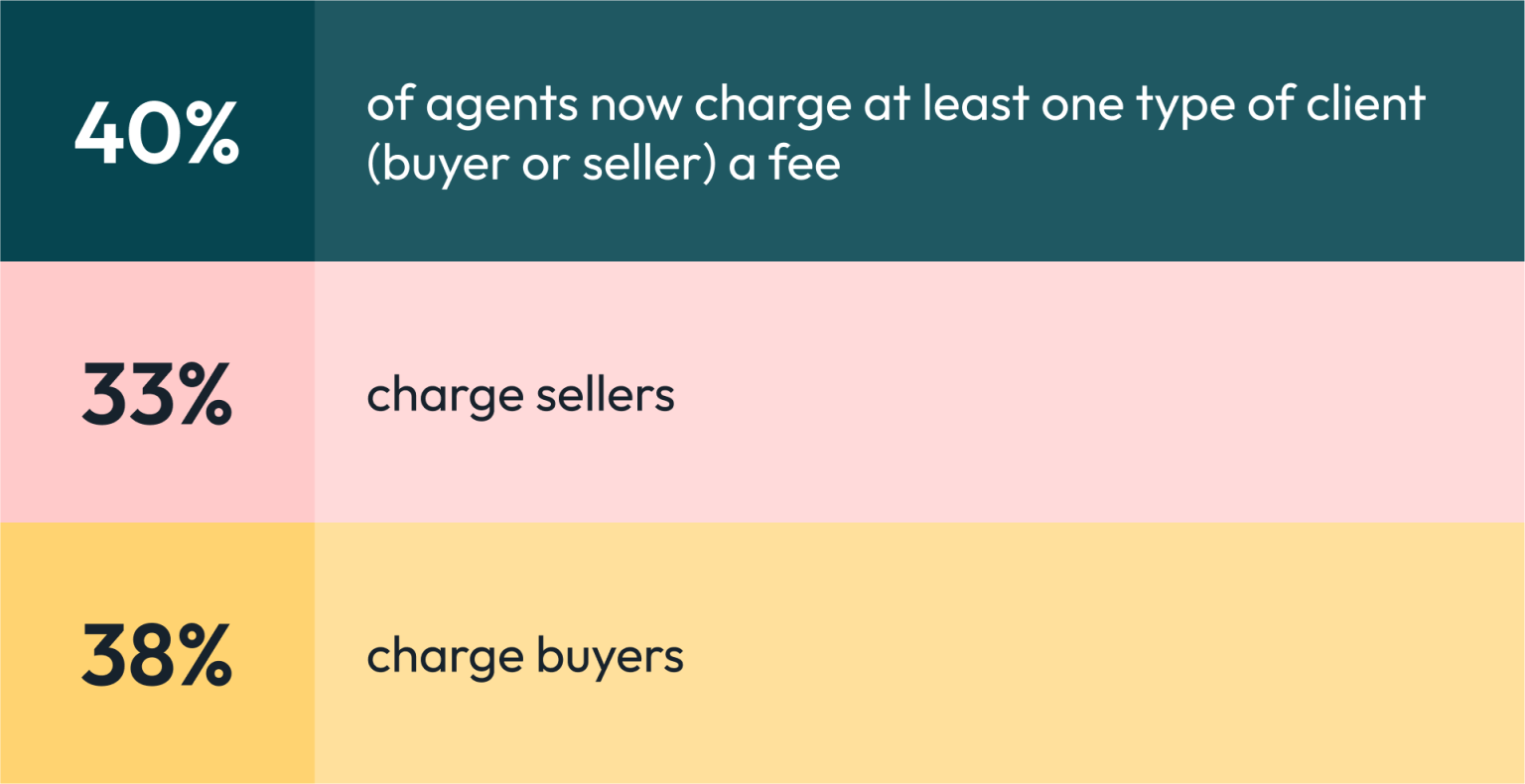

40% of agents now charge at least one type of client (buyer or seller) a fee

-

33% charge sellers

-

38% charge buyers

It’s worth noting that this is an inward-looking dataset. There’s a natural bias toward charging because a) it’s possible with Kotini, and b) we make it extremely simple for agents to charge seamlessly in their onboarding experiences.

What fees look like in practice

The most common fee levels are modest:

-

£50 (incl. VAT) on the sales side

-

£40 (incl. VAT) on the purchase side

When collected automatically online, these small amounts are painless for clients and powerful for agents. They improve cash flow, reduce wasted time, and set a tone of commitment from day one.

Buyer fees: filtering for intent

We see agents often worrying about charging buyers. In reality, when fees sit between £25–£40, pushback is almost non-existent. The agents using buyer fees most effectively aren’t doing it to chase revenue they’re filtering for commitment. If a buyer won’t cover a small admin fee upfront, how serious are they about the purchase?

Seller fees: packaging the value

On the sales side, we see two dominant strategies being used:

-

Treating it like an EPC: Like an EPC, identity, anti-money laundering, and ownership checks are legislative obligations that must be completed before going to market. This fee is positioned as another necessary step that incurs third-party costs. Very matter of fact. It is what it is approach.

-

Bundling into a package: A broader onboarding and marketing fee, typically £100–£250, that sets the expectation of upfront investment. This often covers admin, compliance, and initial marketing activity, positioning the payment as part of a professional, structured launch.

Kotini allows these packages to be configured once, saved as templates, and applied instantly, removing the friction that usually comes with charging.

Higher fees at the upper end of the market

It’s unlikely to be a surprise that at the upper end of the market, upfront fees are typically larger. Here, the principle shifts: it’s not about covering small admin costs or filtering for commitment, but about recognising that premium results require premium investment. Uniquely, the fee also signals a shared investment between agent and seller in achieving the best possible result.

What it means for agents

Upfront fees aren’t just about revenue. They’re about protecting cash flow and securing early buy-in. With Kotini handling the process end-to-end (fee templates, branded payment experiences, automatic reconciliation), agents can confidently introduce fees without fear of admin overhead or awkward conversations.

For more information: https://www.kerfuffle.com/suppliers/kotini